“Technology carriers and channel companions in the Asia Pacific place face the sudden project of coping with the surprising outbreak of COVID-19 (coronavirus). The disaster was once mostly unforeseen, even in mid-January. Most leaders this 12 months have been waiting for disruption from political instability and herbal disasters, now not an epidemic,” wrote Sharon Hiu, an analyst at Canalys in a separate report.

Coronavirus has had an have an effect on on PC provide chains regardless of the tough work of the enterprise to counter the terrible impacts.

Figures from principal analysts have started out to emerge giving a image of what befell in the first quarter and how tons of an have an impact on Covid-19 has had on the industry.

Demand surged thanks to the shift in the direction of domestic working, however a PC enterprise nonetheless improving from Intel chip provide problems discovered that lifestyles grew to be even extra tough as soon as the Chinese factories closed in February and remained shuttered for weeks.

Canalys

The channel analyst located that the PC market declined by way of 8% in the first quarter, with coronavirus to blame.

The first three months noticed 53.7 million units, consisting of desktops, laptops and workstations, shipped with the set up seller line-up of Lenovo, HP and Dell final in place. Apple used to be the hardest hit, with declines of 20% in Q1.

“The PC industry has been boosted with the aid of the international Covid-19 lockdown, with merchandise flying off the cabinets during Q1,” stated Rushabh Doshi, lookup director at Canalys. “But PC makers started out 2020 with a restricted grant of Intel processors, brought on by using a botched transition to 10nm nodes. This was once exacerbated when factories in China had been unable to reopen after the Lunar New Year holidays.

“The slowdown in grant met with accelerated demand, as organizations have been abruptly compelled to equip a newly far flung workforce, setting pressing orders for tens of hundreds of PCs.”

Doshi pointed out that it used to be no longer simply workplace employees who wanted science and the significant closure of colleges had additionally affected demand.

“Children, too, wanted their very own PCs as colleges closed and instructions went online,” he said. “The urgency of demand from each the client and business sectors, mixed with the scarcity of supply, intended system fee used to be no longer the key consideration. Instead, velocity of furnish used to be the most vital factor.”

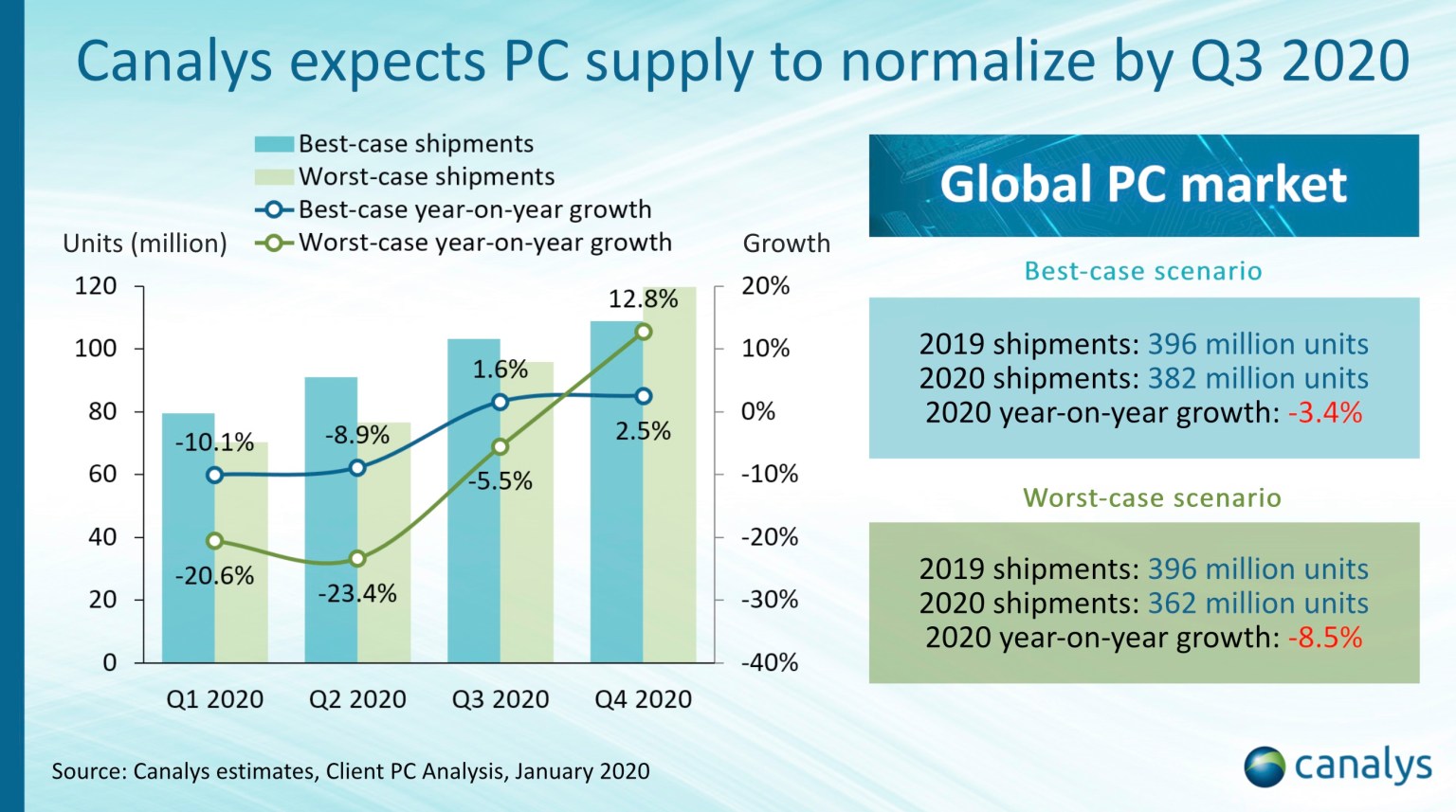

Canalys expects the predominant companies to file sturdy effects for Q1 thanks to the surge in demand from users, however has warned that the modern-day state of affairs is not going to final and the potentialities for the relaxation of the 12 months are much less certain.

Ishan Dutt, analyst at Canalys, said: “As we pass into Q2, the manufacturing constraints in China have eased. But the spike in PC demand considered in Q1 is now not in all likelihood to be sustained and the relaxation of the 12 months appears much less positive. Few companies will be spending on science for their offices, whilst many residences will have been freshly equipped.

“Many components of the tech enterprise have benefited from the early phase of this superb lockdown period, however we assume to see a massive downturn in demand in Q2 2020. With factories now reopened and truly up to full pace in China, PC carriers will face a venture to manipulate grant chain and manufacturing successfully over the subsequent three to six months.”

|

| Image Source - Google | Image by - techcrunch.com |